Stop Losing Clients to PEO: Why Brokers Must Act Now

October 27, 2025

Every renewal this season seems to sound the same. Rates are up. Costs are climbing. Employers are frustrated, and agents are repeating the same lines again and again. That fatigue is real, and it creates risk. When the conversation never moves beyond the number, clients start looking elsewhere for fresh ideas.

We know you are tired of carrying that same message into every client meeting. So are your clients. They do not need another reminder that premiums are rising. They need to hear what comes next.

That is where PEO belongs. A Professional Employer Organization can be the right solution for small and mid-sized employers who are struggling with compliance, multi-state complexity, or benefit costs. When introduced the right way, it does not replace the broker. It protects relationships and strengthens your role.

Why PEO Is on the Table in 2026

Small employers are under pressure. Renewals outpace revenue growth. Compliance requirements overwhelm limited HR staff. Multi-state employees add payroll and tax headaches. Employee turnover is rising as benefits get thinner.

PEO answers these challenges by bundling HR, payroll, compliance, and benefits into one platform. Employers gain access to richer benefits, streamlined compliance, and consistent coverage across states.

For brokers, the reality is simple: PEO sales teams are already calling your clients. If you are not prepared to talk about PEO, someone else will.

The Misconceptions That Hold Employers Back

Many employers hesitate when they hear “PEO,” and those misconceptions can cause brokers to avoid the topic altogether.

If the conversation never happens, employers fill the gaps with assumptions. That is when outside voices step in.

Client Triggers: When the PEO Conversation Should Happen

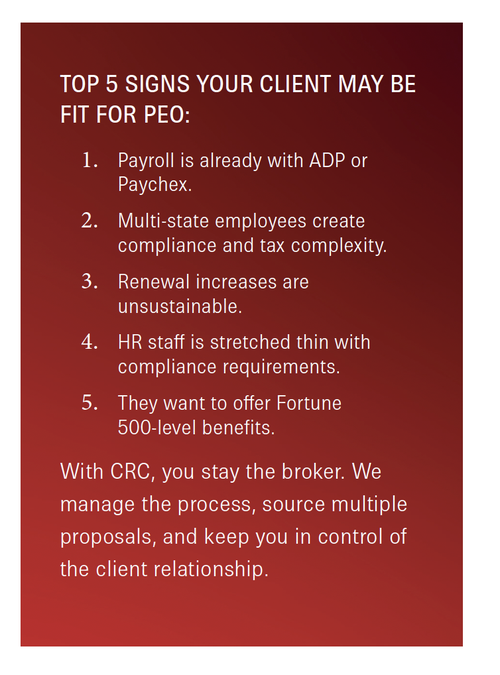

The best time to bring up PEO is before frustration builds into a bigger issue. Watch for these triggers in your client base:

Spotting these triggers early allows you to present PEO as a proactive solution, not a reactive last resort.

How CRC Extends Your Team

Sorting through dozens of PEOs is overwhelming. Evaluating even five providers can mean weeks of paperwork, meetings, and demos. CRC makes the process simple.

The result: you bring clients a polished solution quickly, without taking on 45 hours of extra legwork.

Employer Outcomes: What PEO Delivers

Employers do not just want features; they want results. The right PEO delivers outcomes that resonate with business owners and HR leaders:

When you bring PEO to the table, you are not just talking about another benefits option. You are showing employers how to solve real business problems.

Future-Proofing the Broker Relationship

PEO is not only about solving today’s renewal problem. It is also a bridge to the future.

As clients grow, their needs change. PEO can carry them through early stages of expansion, simplifying HR and compliance when resources are thin. Once they outgrow the PEO model, they are often ready for level-funded or self-funded strategies.

Brokers who introduce PEO now position themselves to guide the client at every stage of growth. Instead of watching a relationship end when a business evolves, you remain their partner across the full lifecycle.

Why This Matters

Employers are not just tired of higher costs. They are tired of conversations that stop at higher costs. When brokers fail to bring new strategies, clients explore other options.

Bringing PEO into the discussion changes the dynamic. Instead of repeating “costs are up,” you are the broker offering a next step. That strengthens your relationship and positions you as the partner who delivers more than numbers.

Bottom Line

PEO is not the right fit for every group, but when it is, it can save clients time, reduce costs, and strengthen benefits. Most importantly, introducing it first ensures your clients hear about it from you, not a competitor.

CRC Benefits is an extension of your team. Our PEO practice is proven. We manage the details, streamline the process, and leverage our relationships with top providers so you can focus on your client.

If you have groups showing signs of renewal fatigue, compliance pressure, or multi-state complexity, now is the time to act. Contact your CRC Benefits team today to access proposals, demos, and support that help you protect and strengthen every client relationship.

Contributors

Rob Schlossberg is the Director of the National PEO division and works out of CRC Benefit’s Melville, New York office.

Ari Wind Broker is a Sales Executive with the PEO division and works out of CRC Benefit’s Melville, New York office.