Making Sense of Taxability in Long-Term Disability Plans

November 24, 2025

When employees think about income protection, most assume their long-term disability (LTD) coverage will replace a certain percentage of their paycheck if they can’t work. The truth is, that number isn’t always what it seems.

Taxes can quietly shrink the actual benefit—sometimes by thousands of dollars a year. For employers and brokers, understanding how LTD benefits are taxed is more than a compliance detail. It’s part of delivering on the promise of protection and keeping plans aligned with what employees really need.

Why Taxability Matters

In a typical setup, the employer pays LTD premiums with pre-tax dollars. That sounds efficient, but it means the benefits are taxable when an employee goes on claim. So while the plan might advertise 60 percent income replacement, after taxes, the real number may land closer to 40 or 45 percent.

That gap can catch people off guard. When someone is suddenly out of work due to illness or injury, they’re already facing medical bills and lifestyle changes. Having less income than expected adds unnecessary stress.

That’s where a gross-up plan comes in—a small structural change that can make a big difference in the benefit’s take-home value.

What a Gross-Up Plan Really Does

A gross-up simply means the employer adds a small, taxable amount to employees’ paychecks each year to cover the taxes on the LTD premium. Once taxes are paid on that extra income, the premium is considered paid with after-tax dollars. The result? If an employee ever needs to claim LTD benefits, those payments come in tax-free.

Think of it as prepaying the taxes upfront, rather than having the employee pay them later during a difficult time.

Here’s how it breaks down:

Employer’s role: Add the cost of the LTD premium to the Employee’s taxable income, handle withholding and employer payroll taxes, and continue paying the LTD premium.

It’s not a new product or a complex add-on, just a smart adjustment to how the plan is structured.

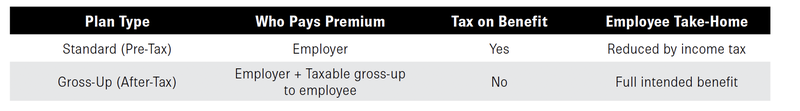

Standard Plan vs. Gross-Up Plan

A side-by-side comparison often makes it click for clients: it’s not about adding cost but about shifting when and how the taxes are handled.

Why the 50%Gross-Up Often Hits the Sweet Spot

Here’s where things get interesting. Most LTD plans cover 60 percent of income. Some employers push that to 66⅔ or 70 percent to make the benefit feel more generous. But higher percentages come with higher premiums.

A 50 percent gross-up plan often delivers the same real-world protection as a higher taxable benefit at a lower overall cost.

When you model the numbers, it’s easy to see why:

It’s a win-win: the employee gets the full 50 percent benefit without tax erosion, and the employer keeps premiums efficient.

Why Employers Choose Gross-Up Plans

Gross-ups are one of those rare opportunities where everyone benefits.

For employees: It provides clarity. They can count on their benefit amount without needing to calculate post-tax estimates during an already stressful time.

For employers: It’s a small administrative tweak that signals care and financial savvy. Instead of spending more on premiums, they can use the same dollars to create a more effective, tax-free benefit.

For brokers and consultants: It’s an easy way to demonstrate added value. Explaining how a gross-up works takes only a few minutes but can completely change how a client views their LTD offering.

At CRC Benefits, our Ancillary team regularly helps employers review current LTD structures and model side-by-side comparisons. The goal is simple: Show the impact of taxability on take-home income and help brokers recommend what’s most effective for their clients.

Clearing Up Common Misunderstandings

Gross-up plans sound simple, but they can create confusion if not explained clearly.

Here are a few talking points brokers can use:

Educating employees upfront builds trust and ensures they understand the value behind the coverage they’re paying for, directly or indirectly.

The CRC Benefits Advantage

Our Ancillary team helps brokers and employers simplify these decisions. We translate tax and benefit jargon into plain language that resonates with clients and employees. Whether it’s modeling plan options, reviewing cost impact, or crafting clear employee communications, our focus is on helping you deliver value that’s easy to understand and easy to appreciate.

The Bottom Line

Long-term disability coverage should create stability, not surprises. A 50% gross-up LTD plan gives employees confidence that

what’s promised is what they’ll actually receive and offers a cost-efficient way for employers to strengthen their benefits package.

Helping clients understand this option positions you as more than just a plan administrator. CRC Benefits’ Ancillary team is here to support that conversation with data, design insights, and communication tools that make LTD coverage clear, compliant, and truly protective.

Contributors:

Christopher Landis is a Sales Executive for Ancillary at CRC Benefits.

David May is a Sales Executive for Ancillary at CRC Benefits.

John Otness is a Sales Executive for Ancillary at CRC Benefits.

The information herein should not be construed as tax advice in any way. This is meant for informational content only. You should seek the advice of your tax consultant for additional or specific information.